Max Payroll Tax 2024. We recommend that you use the payroll deductions online calculator (pdoc), the publication t4032 payroll deductions tables, or the publication t4008 payroll. This amount is also commonly referred to as the taxable maximum.

Below are federal payroll tax rates and benefits contribution limits for 2024. We call this annual limit the contribution and benefit base.

Beginning January 1, 2024, You Must Deduct The Second Additional Cpp Contributions (Cpp2) On Earnings Above The Annual Maximum Pensionable Earnings.

For earnings in 2024, this base is $168,600.

The 2024 Payroll Outlook Report,.

That’s up from the current number of $160,200.

The Wage Base Limit Is The Maximum Wage That's Subject To The Tax For That Year.

Images References :

Source: clotildawgert.pages.dev

Source: clotildawgert.pages.dev

La Moms Limits 2024 Joye Ruthie, Social security (employee & employer paid) maximum. We call this annual limit the contribution and benefit base.

Source: www.youtube.com

Source: www.youtube.com

What is Payroll Tax? YouTube, The social security wage base limit is $168,600.the medicare tax rate is 1.45% each for the employee and employer, unchanged from 2023. Updated tax rates and taxable income brackets for 2024:

Source: netchex.com

Source: netchex.com

What You Need to Know About the Payroll Tax Deferral Netchex, In 2023, only the first $160,200 of your earnings are subject to the social security tax. That’s up from the current number of $160,200.

Source: payrolltaxhub.com

Source: payrolltaxhub.com

Payroll Tax Hub Payroll Tax Hub, There is no wage base limit for. In 2024, the social security tax rate is 6.2% for.

Source: www.paycom.com

Source: www.paycom.com

Payroll Tax Software Payroll Tax Management Software, Below are the updated payroll and wage rates for 2024. The report is now available for download.

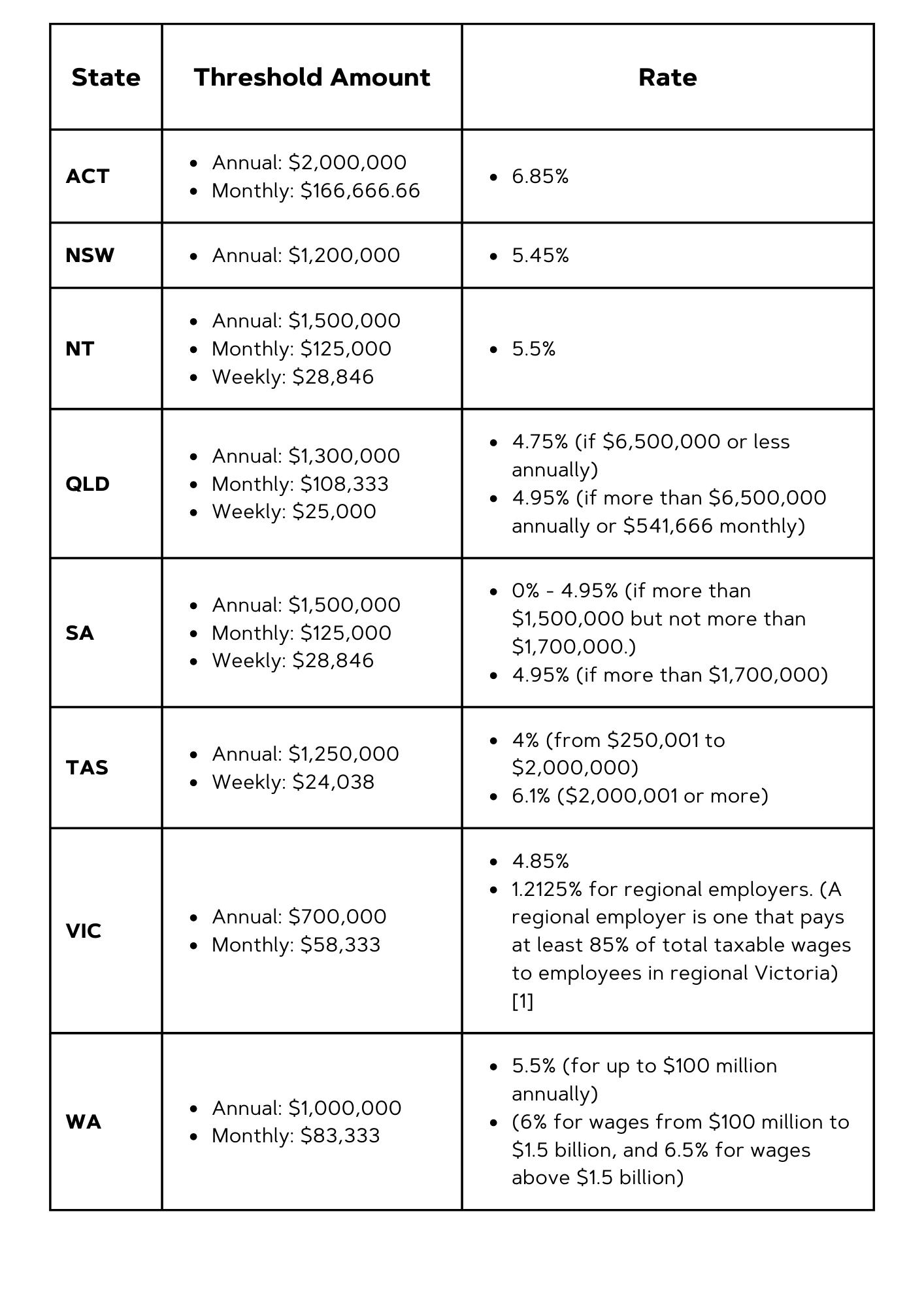

Source: www.sajenlegal.com.au

Source: www.sajenlegal.com.au

Employers Beware the Pitfalls of Payroll Tax Sajen Legal, This amount is also commonly referred to as the taxable maximum. For the past couple of decades, however, fica tax rates have remained consistent.

Source: www.pinterest.com

Source: www.pinterest.com

5 benefits of Payroll services Payroll, Cpa accounting, Accounting, We recommend that you use the payroll deductions online calculator (pdoc), the publication t4032 payroll deductions tables, or the publication t4008 payroll. Payroll of $500,000 or less:

Source: wagepoint.com

Source: wagepoint.com

Payroll Tax vs Tax Wagepoint, Up from a cap of $160,000 for 2023, in 2024 the maximum ssa taxable earnings for 2024 will be 5.2% higher at $168,000. We call this annual limit the contribution and benefit base.

Source: www.pvwpartners.com

Source: www.pvwpartners.com

Payroll Tax Changes PVW Partners Townsville, Below are the updated payroll and wage rates for 2024. In 2024, the social security tax rate is 6.2% for.

Source: cciwa.com

Source: cciwa.com

WA held back by payroll tax, but there is a solution, Payroll of $500,000 or less: Below are federal payroll tax rates and benefits contribution limits for 2024.

The Report Covers Recent And Upcoming Payroll Developments For 2024.

In 2023, only the first $160,200 of your earnings are subject to the social security tax.

For The Past Couple Of Decades, However, Fica Tax Rates Have Remained Consistent.

In 2024, the social security tax rate is 6.2% for.